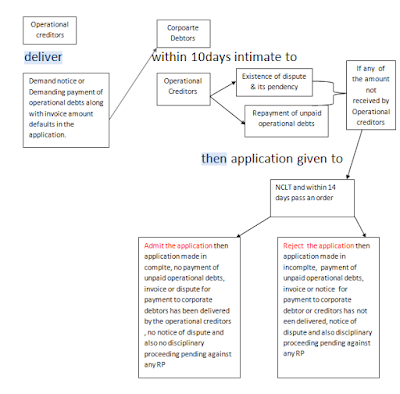

Section 8 Insolvency resolution by operational creditors

An operational creditors may occurs

a defaults then delivered a demand notice or demanding payment of operational

debts along with invoice to the corporate debtors in such form and the manners

as may prescribed and within 10 days

from the Receipts of the demand notice or copy of the invoice mention in

sub-section-1 given to the intimation to the operational creditors.

- Existence of dispute and its Pendency

- Repayment of unpaid operational debts

|

| SECTION 8 CHART |

Section 9 Application for initiation of corporate insolvency resolution process by operational creditors

If the operational creditors not

received any amount then operational creditors made an application and given to

Adjudicating Authority (NCLT), operational creditors shall furnish a

application along with following documents to be attached are as:-

- Invoice

- Affidavit

- Certificate for financial institutions

- Other information

NCLT within 14 days from

the receipts of the application pass an order

If NCLT

Admit the application then,

- Application made is complete

- No payment of unpaid operational Debts

- Invoice notice for payment to corporate debtors has been delivered by the Operational Creditors

- No notice of dispute

- No disciplinary proceeding pending against any resolution professional proposed.

If NCLT Reject

the application then, NCLT after giving a notice

to the applicant to rectify the defect within 7 days

- Application made is incomplete

- Payment of unpaid operational Debts

- Creditors has not delivered Invoice notice for payment to corporate debtors

- Notice of dispute has been received

- Disciplinary proceeding pending against any resolution professional proposed

|

| Section 9 Chart |

Section 10 Initiation of corporate insolvency resolution process by corporate applicant

If the corporate applicant commit a defaults

then application made by the corporate applicant along with the application

following documents shall be furnish as a books of accounts & such other

documents and Resolution professional proposed to acts as interim resolution

professional and the special resolution passed by shareholders of the corporate

debtors or the resolution passed by atleast 3/4th

of the total numbers of the parters of the corporate debtors, as the

case may be, approving filing of the application then after all the document

along with application given to the NCLT by the corporate applicant and then

after NCLT within 14 days from the date of receipts of the applications pass

the order,

If NCLT admit the application

then application is complte and after commencement of corporate insolvency

resolution process,

If NCLT Reject the

application then application is incomplete and after giving a notice to the

applicant to rectify the defect within 7 days.