Income-tax Act, First

Proviso to Section 48 and Rule 115A

Capital

gain on transfer of shares/debentures by non-resident

Applicable on NON RESIDENT ASSESSEE (NOT BEING AN

ASSESSEE COVERED U/S 115AC AND 115AD)

If the non-resident assesses purchase its shares and debentures of an Indian company by utilizing the foreign currency and then after-sale this shares and debentures of an Indian company acquired through reinvestment, whether the assets may be long term capital gain or short term capital gain, and this Income-tax Act, First Proviso to Section 48 and Rule 115A is not applicable to UNIT OF UTI & MUTUAL FUNDS, and the above proviso, not any BENEFIT OF INDEXATION shall be available. The methods of computation are mandatory and not optional.

|

| First proviso sec 48 & rule 115 A |

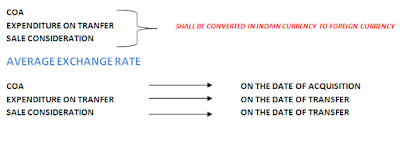

Procedure: - Capital gain arising on transfer of above assets shall be computed as under:-

|

| PROCEDURE |

The average exchange rate is an average of the telegraphic transfer buying rate & telegraphic transfer selling rate.

Special tax

rate for long term capital gain in some cases SECTION 112(1)(c)

This above section shall be applicable to a non-resident or a foreign company and some condition should be satisfied are:-

Long term capital gain arising on transfer of capital assets BEING UNLISTED SECURITES / SHARES of a company in which public are substantially interested and without giving effect on the FIRST PROVISO TO SECTION 48- Capital gain in foreign currency and SECOND PROVISO TO SECTION 48- Index benefit.

No comments:

Post a Comment