Section 115 A (1)(a) of Income tax act –Special Tax Rate

Section 115 A(1)(a)

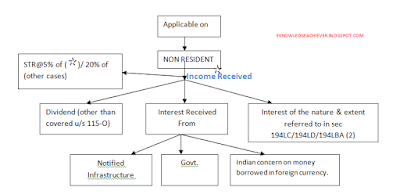

This section 115 A(1)(a) is applicable on NON RESIDENT and Income covered if the nonresident received a Dividend (other than covered u/s 115-O) or interest received from Infrastructure bonds /govt./Indian concern or the Indian company on money borrowed in foreign currency or interest of the nature referred of the nature to in section 194 LC/194 LD /194 LBA(2) then this income received to be tax in the special rate @5% in this income and other income will be taxed on 20%. Allow-ability of expenditure under section 28 to section 44 C & section 57 is not applicable and Deduction under chapter VI A is not applicable for this section 115 A(1)(a) exception Deduction u/s 80 LA can be claimed by a UNIT OF AN INTERNATIONAL FINANCIAL SERVICES CENTER, Indexation benefit is not applicable and Requirement to furnish return is not mandatory.

|

| Section 115 A(1)(a)-CHART |

Section

115 A(1)(b) of Income tax act-Special Tax Rate

Section 115 A(1)(b)

This section 115 A(1)(a) is applicable on NON RESIDENT and Income covered if the nonresident received a Royalty or fees for technical services ( other than income covered u/s 44 DA) received as per agreement entered with Govt. or Indian company /concern on or after 1-4-1976. *Indian concern means the where the such agreement is with Indian concern, the agreement is approved by the CG. then this income received to be tax in the special rate @10% in this income. Allow-ability of expenditure under section 28 to section 44 C & section 57 is not applicable and Deduction under chapter VI A is applicable for this section 115 A(1)(b), Indexation benefit is not applicable and Requirement to furnish return is required or its applicable.

|

| Section 115 A(1)(b)-CHART |

Section 115 AB of Income tax act-Special Tax Rate

Section

115 AB

This section 115 AB is applicable on (OFO)- OVERSEAS FINANCIAL ORGANISATION and Income covered if the (OFO)- OVERSEAS FINANCIAL ORGANISATION is agreement with IN INDIA, Public Sector Bank / Public Financial Institution / Mutual funds u/s 10(23D) is approved by SEBI and purchase FUNDS etc.. from , Public Sector Bank / Public Financial Institution / Mutual funds u/s 10(23D) in FOREIGN CURRENCY and then purchase funds likes:- UNITS OF UTI / MUTUAL FUNDS u/s 10(23D) is sales or transfer the LTCG arising and Special Tax rate @10%, Allow-ability of expenditure under section 28 to section 44 C & section 57 is not applicable and Deduction under chapter VI A is not applicable for this section 115 AB, Indexation benefit is not applicable and Requirement to furnish return is required or its applicable.

|

| Section 115 AB-CHART |

Section 115 AC of Income tax act-Special Tax Rate

Section 115

AC

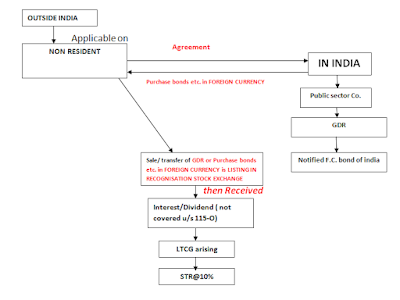

This section 115 AC is applicable on NON RESIDENT and Income

covered if the nonresident received INTEREST on notified Foreign currency bonds

of India / Public Sector Company and Dividend ( other then covered u/s 115-O) on

GDR, and its listing in recognized stock exchange and the transfer the GDR or

bonds then LTCG arising and Chargeable a

Special Tax Rate@10%.Allow-ability of expenditure under section 28 to section

44 C & section 57 is not applicable and Deduction under chapter VI A is not applicable

for this section 115 AC, Indexation benefit is not applicable and Requirement to

furnish return is not required or not mandatory.

|

| Section 115 AC- CHART |

https://eknowledgeachiever.blogspot.com/2020/07/poem-place-of-effective-management.html

PLACE OF EFFECTIVE MANAGEMENT-(POEM) INCOME TAX

IF YOU SEE THIS ABOVE POEM TOPIC THEN CLICK THE LINK AT MENTION ABOVE

No comments:

Post a Comment