INSOLVENCY AND BANKRUPTCY CODE 2016

Introduction

The

Insolvency and Bankruptcy Code passed by the Parliament is an invite upgrade of

the current structure managing bankruptcy of corporate, people, organizations

and different substances. It clears the path for much required changes while focusing on lender driven indebtedness goals.There were various covering laws

and NCLT ( in case company)/DRT ( in case of firms & Individuals) deals with

business failures and insolvency of organizations and people or a members

India. The basic legistative categories are :-

(a) CH- 19 & Ch-20 of Companies Act, 2013

(b) Part VIA, Part VII and Sec- 391 of Companies Act, 1956

(c) RDDBFI Act, 1993

(d) SARFAESI Act, 2002

(e) SICA Act, 1985

(f) The Presidency Towns Insolvency Act, 1909

(g) The Provincial Insolvency Act, 1920

(h) CH-13, of LLP Act, 2008

MEANING OF

INSOLVENCY:- It’s a “state”

where assets are insufficient to meet the liabilities. If untreated, insolvency

will lead to bankruptcy for non-corporates and liquidation of corporate.

|

| INSOLVENCY CHART |

NOTE :- Winding up of the organizations is

liquidations. liquidations can be proceeds BY RB ( REGULATORY BODIES),

DIRECTORS, SHAREHOLDERS , UNPAID CREDITORS OF THE ORGANIZATIONS.

|

| CIRP CHART |

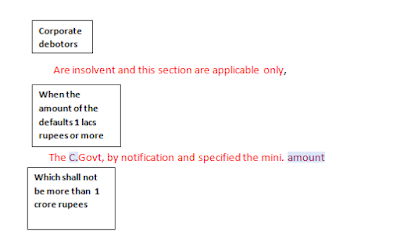

SECTION -4 CORPORATE INSOLVENCY RESOLUTION PROCESS ( CIRP)

The process

is applicable only if a corporate debtors are insolvent and not paid any amount

to financial creditors or unable to pay a debts and its minimum amount defaults

id 1 lacs rupees or more but shall not be more than 1 crore rupees,

Diagram:-

|

| SECTION 4 CHART |

Its most and most important section 7, its more relevant to the

professional exams point of view and

this section 7 I discussed for you in the following diagram:-

Section -7 Initation of corporate insolvency

resolution process by the financial creditors.

If the financial creditors are occurs a defaults then made an application

is given to NCLT along with propers records of the defaults and name of the RP

proposed to acts as IRP, And with another information is also to be given to

the NCLT, and after receipts a application NCLT within 14 days pass an order,

if defaults occurred then application is admitted by NCLT and Process a CIRP (

Corporate insolvency resolution process) and then within 7 days NCLT

communicate to financial creditors and corporate debtors and similarly, if the

defaults is not occurred then NCLT reject the application and also to provide

or send a notice to the applicant to rectified the defects in the application

and within 7 days also to communicate to financial creditors only in case

defaults not occurred.

Diagram:

|

| SECTION 7 CHART |

No comments:

Post a Comment