Section 29A Persons not eligible to be resolution applicant

INSOLVENCY AND BANKRUPTCY CODE, SECTION 29-A :- PERSONS NOT ELIGIBLE TO BE RESOLUTION APPLICANT

- Person shall not be eligible to submit a Resolution plan, if the such person acting or concern with any other persons and is an undercharged insolvent then the such person shall not eligible to be resolution applicant and also the such person is willful defaulter in accordance with the guidelines of the RBI issued under the Banking Regulations Act, 1949 then the such person shall not eligible to be a resolution applicant.

- Submission of resolution plan has an account or account of the corporate debtor under the control and management of the such persons and the such persons is classified as NPA in accordance with the guidelines of the RBI issued under the banking regulations act, 1949. Then the such person shall not be eligible to be resolution applicant.

- From the date of above classification of NPA until 1 year of period has been lapsed till the date of commencement of the CIRP of the corporate debtor.

- Before the submission of resolution plan the resolution applicant paid all overdues amount with interest thereon and charges relating to NPA account paid then the such person is eligible for resolution applicant.

- Where the such applicant is a financial entity and is not a related party to the corporate debtor then the such person is eligible for resolution applicant.

- If the Resolution applicant has been convicted for any offence punishable with imprisonment for 2 years or more under any act specified under the 12th schedules or for 7 years or more under any law for the time being in force then the such person is not eligible to be a resolution applicant.

- If the such person is disqualified as a director under the companies act,2013 and also is related to be a connected person then the such person shall not be eligible to be a resolution applicant.

- Is prohibited by SEBI then the such person is not eligible to be a resolution applicant.

- Promoters /management & control of the corporate debtor and following transaction has been taken place likes as:- preferential transaction, extortionate credit transaction, undervalued transaction, fraudulent transaction in respect of which order has been made by NCLT.

- Shall not apply the following transaction prior to the acquisitions of the corporate debtor by the resolution applicant pursuant to a resolution plan approved under this code then the such person shall not be eligible to be a resolution applicant.

- If the resolution applicant has execute a guarantee in favour of the creditor in respect of the corporate debtor then the such resolution applicant is not eligible.

- Is subject to any disability clause under (a) to (h) under any law in a jurisdiction outside india or has a connected person not eligible under clause (a) to (i).

- Where the resolution applicant is a financial entity and it’s not a related party then the such resolution applicant is eligible u/s29.

Section 30 Submission of Resolution Plan

INSOLVENCY AND BANKRUPTCY CODE, SECTION 30 SUBMISSION OF RESOLUTION PLAN

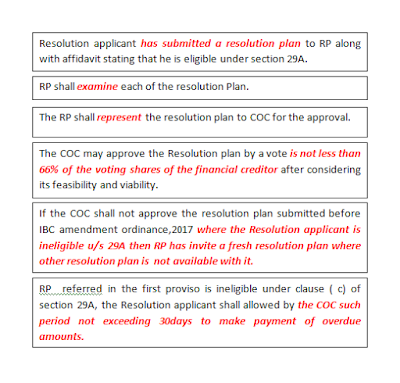

Resolution applicant has submit a resolution plan to RP along with affidavit stating that he is eligible under section 29A.

RP shall examine each of the resolution plan and to confirm that each resolution plan.

- payments of insolvency resolution process cost is the manner specified by the board.

- Payments of debts of operational creditors in such manner as may specified by board.

- Management of affairs of the corporate debtor.

- Implementation and supervision of the Resolution Plan.

- Does not contravene any provisions of the law.

Note :- If the COC shall not approve the resolution plan submitted before IBC amendment ordinance,2017 where the Resolution applicant is ineligible u/s 29A then RP has invite a fresh resolution plan where other resolution plan is not available with it.

Note :- RP referred in the first proviso is ineligible under clause ( c) of section 29A, the Resolution applicant shall allowed by the COC such period not exceeding 30days to make payment of overdue amounts.

- Resolution applicant may attend the meeting of the COC.

- Resolution applicant has not right to vote at the meeting of the COC.

- RP submit the plan to RP and RP approved by COC and COC to NCLT.

|

| SECTION 30-CHART |

Section 31 Approval of Resolution Plan

INSOLVENCY AND BANKRUPTCY CODE, SECTION 31 APPROVAL OF RESOLUTION PLAN

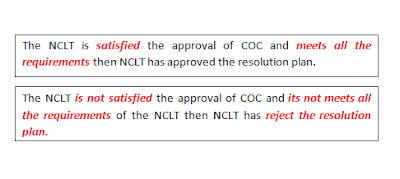

- If the NCLT is satisfied the approval of COC and meets all the requirements then NCLT has approved the resolution plan.

- If the NCLT is not satisfied the approval of COC and its not meets all the requirements of the NCLT then NCLT has reject the resolution plan.

Now after the order of approval under sub-section (1)

- The moratorium order passed by the NCLT shall be cease.

- RP shall forwards all records and plan to IBBI to be recorded on its database.

Section 32 Appeal

INSOLVENCY AND BANKRUPTCY CODE, SECTION 32 APPEAL

Any appeal from an order approving the Resolution plan shall be in the manner and on the grounds laid down in section 61(3).

No comments:

Post a Comment