TDS U/S 194E,194LB, 194LBA OF INCOME TAX ACT

Section

194E TDS ON PAYMENT TO NON RESIDENT SPORTSMAN OR NON RESIDENT SPORT

ASSOCIATIONS

|

| Sec 194E-Non Resident Sportsman |

Sportsman

or entertainer being a non resident foreign citizen participate in INDIA in any

GAMES or SPORTS/ ADVERTISING/ CONTRIBUTION OF ARTICLES relating to any games or

sports IN ANY NEWSPAPER/MAGAZINE OR JOURNAL. And any income is to be received by the SPORTSMAN

that income shall be DEDUCT A TDS @20% ( + surcharge + Health + Education Cess)

and SPORTS ASSOCIATION being a non resident is organised a SPORTS OR ANY GAMES

IN INDIA then the SPORTS ASSOCIATION received the income that income shall be liable to pay a TDS RATES

@20%( + surcharge + Health + Education Cess). And when tax shall be deducted: - AT THE TIME OF

PAYMENT OR CREDITING THE PAYEE WHICHEVER IS EARLIER.

Section

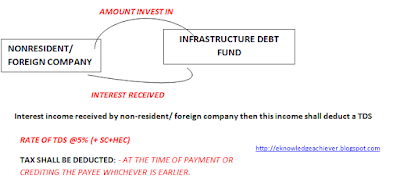

194LB TDS ON INTEREST FROM INFRASTRUCTURE DEBT FUND

|

| Sec 194LB-Infrastructure Debt Fund |

NON RESIDENT/ FOREIGN COMPANY received the interest income from the INSFRASTUTURE BEDT FUND, then INSFRASTUTURE BEDT FUND to paid a interest income to non resident or foreign company after deduct a TDS of that income, the Interest income shall be liable to pay a TDS RATES @5%( + surcharge + Health + Education Cess). And when tax shall be deducted: - AT THE TIME OF PAYMENT OR CREDITING THE PAYEE WHICHEVER IS EARLIER.

Section 194LBA TDS ON CERTAIN INCOME FROM UNITS OF A BUSINESS TRUST

|

| Sec 194LBA-Units of Business Trust |

Resident unit holder/ Non Resident unit holder/ Foreign

Company unit holder is unit hold of the UNITS OF A BUSINESS TRUST and the UNITS

OF A BUSINESS TRUST payment is made to Resident unit holder/ Non Resident unit

holder/ Foreign Company unit holder then this income deduct a TDS as per Section

10(23FC)/ Section 10(23FCA), when tax shall be deducted: - AT THE TIME OF PAYMENT OR

CREDITING THE PAYEE WHICHEVER IS EARLIER.

|

PAYEE |

Rate of TDS Section 10(23FC) |

Rate of TDS Section 10(23FCA) |

|

Payment is made

to a RESIDENT UNIT HOLDER |

10% |

10% |

|

Payment is made

to a unit holder being NON RESIDENT |

5% |

30%+SC+HEC |

|

Payment is made

to a unit holder being a FOREIGN COMPANY |

5% |

40%+SC+HEC |

IF YOU SEE THE MORE DETAILS ABOUT THE NON RESIDENT- SPECIAL TAX RATES THEN CLICK THE BELOW LINK

No comments:

Post a Comment